For years, sending money to Nigeria meant navigating a maze of slow processing times, complicated procedures, and inflated fees. Traditional banks, with their legacy systems and hidden costs, made the process feel like a burden — both financially and emotionally. But that’s no longer the case. In 2025, people are finding faster and smarter ways to send funds back home. And let’s be honest: banks aren’t thrilled about it.

A growing number of Nigerians abroad are choosing digital platforms that cut through the clutter. One of the most effective tools available today is send money to Nigeria, a streamlined solution that allows you to complete a secure transfer in just a few clicks — often in less time than it takes to make a cup of coffee.

What’s behind the shift? It starts with speed. Unlike traditional bank transfers, which can take days to clear due to internal routing, currency conversion delays, and manual approval processes, newer platforms are built for instant processing. With direct integrations to local payout networks in Nigeria, funds can arrive within minutes. That kind of turnaround time is invaluable when a family member is facing an emergency or when a small business needs immediate support.

Another key reason users are walking away from old systems is transparency. Banks have a habit of charging both visible and hidden fees. You might think you’re paying a reasonable $10 for a transfer, but then you notice your recipient received far less than expected. That’s because many banks apply a markup to the exchange rate — essentially pocketing the difference. Over multiple transactions, that margin can cost you hundreds of dollars.

Modern services offer a refreshing alternative. You see the exact cost upfront, with no surprises after you confirm the transaction. That includes real-time exchange rates and a clear breakdown of fees. It’s financial clarity the old system rarely provided, and it empowers users to make smarter decisions with their money.

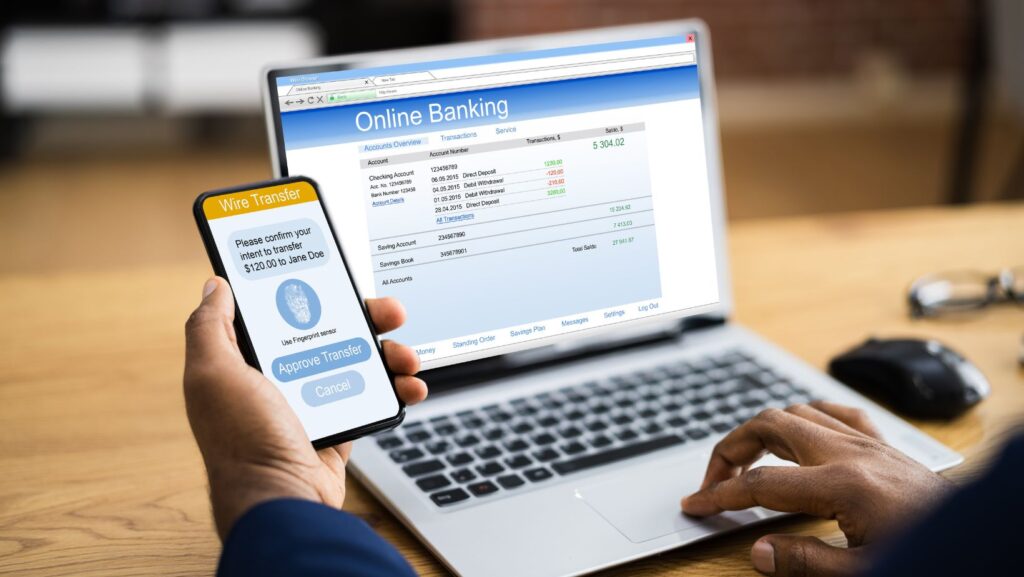

Usability is another game-changer. There’s no need to stand in line at a branch or fill out stacks of paperwork. Everything happens online — often through a simple mobile app. Whether you’re in London, Toronto, New York, or Dubai, you can send money to Nigeria from wherever you are, at any time. This level of convenience has completely redefined expectations for international transfers.

Security hasn’t taken a back seat either. In fact, it’s better than ever. Advanced encryption, two-factor authentication, and regulatory compliance mean your money is protected at every stage of the process. And if something does go wrong, responsive customer support is there to help — another area where traditional institutions often fall short.

But perhaps the biggest win is emotional peace. When you’re supporting family or helping someone in urgent need, knowing that the money will arrive quickly and safely makes a world of difference. No more worrying if the transfer will be delayed or whether the bank will hold funds for additional verification. With the right platform, everything just works — smoothly and predictably.

This shift away from traditional banking models isn’t just a trend. It’s a movement. More people than ever before are demanding speed, transparency, and control — and they’re finally getting it. Banks may resist the change, but the numbers don’t lie: digital remittances to Nigeria are growing rapidly, and user satisfaction is climbing right alongside them.

So if you’re still using outdated methods to send money home, ask yourself: why? In a world where smarter options are readily available, sticking with the slow and expensive route no longer makes sense. The tools for faster, cheaper, and more secure transfers are here — and they’re changing everything.