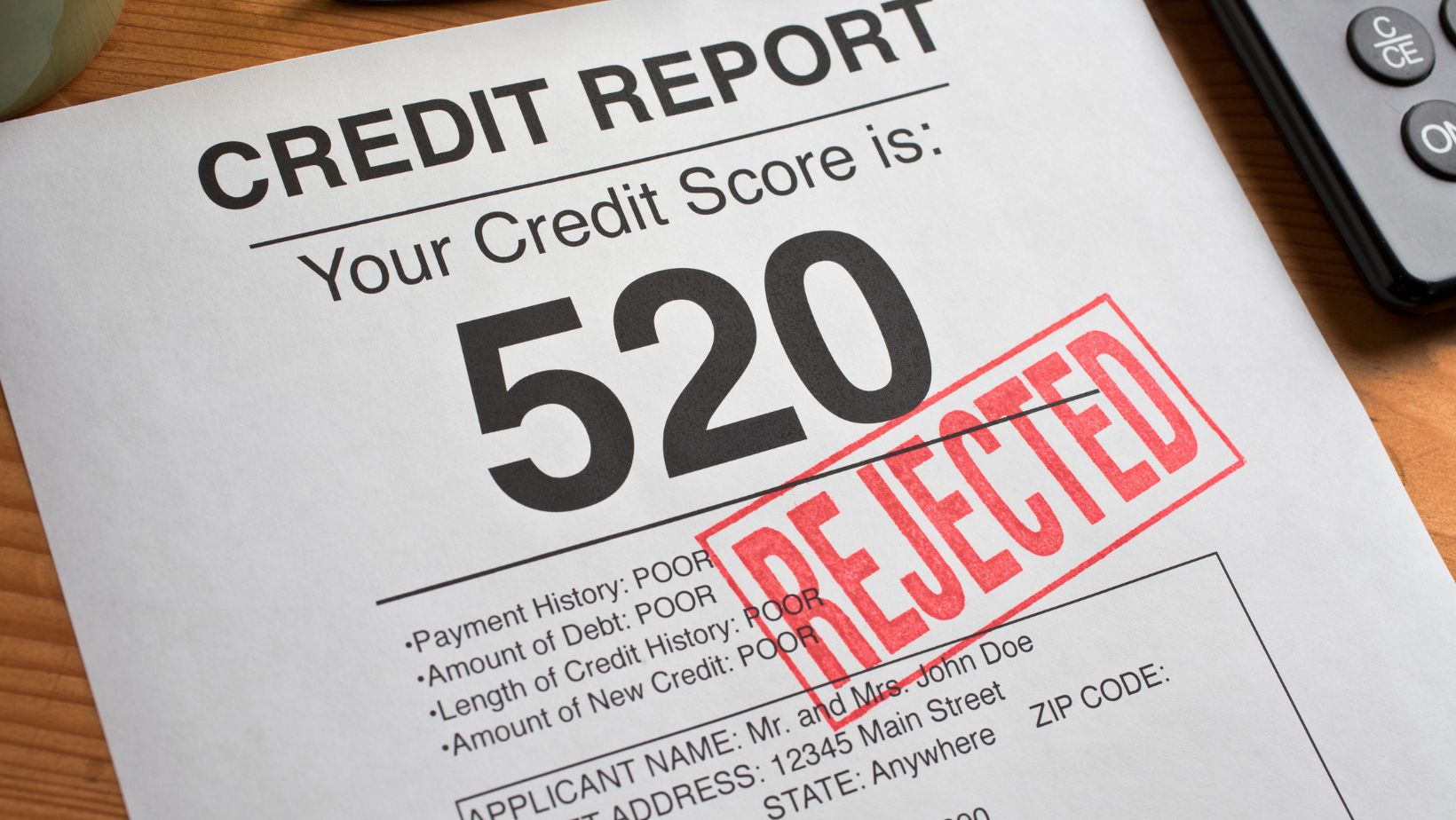

A credit score of 525 can quietly influence several areas of daily life, from qualifying for loans to securing housing or setting up essential services. It can feel limiting, and it’s natural to feel uncertain about what comes next. However, a low score doesn’t have to be permanent. With steady, practical steps, you can begin improving your credit and gradually open the door to better financial opportunities. Here’s how to get started.

Step 1: Check Your Credit Report

Many people feel uncomfortable looking at their credit report when they see a credit score of 525 or lower, but that doesn’t automatically disqualify them from getting loans. However, ignoring it won’t make the problem go away. Improving your credit score starts with identifying the specific factors that are bringing it down. Understanding these issues allows you to take targeted steps toward rebuilding your credit effectively. The first step is to check your credit report. It lists every account, payment record, and negative mark that affects your score. This information gives you a clear picture of where you stand today.

Go to AnnualCreditReport.com to request free reports from Experian, TransUnion, and Equifax. Review each one carefully. Look for incorrect details like accounts you never opened, payments marked late that you made on time, or balances that seem wrong. If you find any mistakes, file a dispute right away. The credit bureau has to review and correct errors if they confirm them. This simple step can boost your score early in your journey.

Step 2: Pay Your Bills on Time

Payment history carries more weight than any other part of your credit score. It makes up about 35 percent of the total. That is why missed or late payments can drag your score down fast. Many people underestimate how much damage a few late payments can do. Once they show up on your report, they tend to stick around for years. However, you can start fresh today by focusing on what you pay moving forward.

Take a good look at all your current bills. This includes credit cards, loans, rent, utilities, and even phone bills. Set up payment reminders using your phone calendar or download a budgeting app to track due dates. Many companies also offer autopay options. You can enroll in those to make sure your payments are never late. On-time payments not only protect your score from getting worse. They also build a positive history that helps your score recover over time.

Step 3: Lower Your Credit Card Balances

Credit card debt plays a huge role in keeping your score low. Many people don’t realize how much their balances affect their credit. High balances tell lenders that you might depend too much on borrowed money. This is why your credit utilization rate is so important. It shows how much of your available credit you are using right now. Experts suggest keeping that number under 30%. Lowering it even more gives your score an even bigger boost.

Take time to gather all your credit card statements. Write down the total limit and the current balance for each one. This helps you see exactly where you stand. Start by paying more than the minimum on the card with the highest fees. This helps you save on extra charges while you reduce your debt. If that feels too hard, try making small extra payments on all your cards. Even an extra ten or twenty dollars makes a difference over time.

Step 4: Avoid Opening New Accounts Too Quickly

Applying for new credit cards or loans can feel tempting when trying to fix your score. You might think adding more available credit will help your credit utilization rate. However, it may seem like a smart move, but applying for multiple lines of credit can actually work against you. Each application triggers a hard inquiry, which stays on your credit report for up to two years and can temporarily lower your score. Too many of these in a short period make you look like you are desperate for credit.

Only apply when you truly need a new account. New credit can sometimes help, but rushing into several accounts can backfire. Opening too many accounts lowers the average age of your credit, which works against you. It is wiser to build a strong record with the accounts you already have, build a strong payment history, and lower your balances before adding anything new. This slow and steady approach shows lenders you are in control of your credit, not rushing to fix it overnight.

Step 5: Keep Old Accounts Open

Closing old accounts might sound like the right move to clean up your credit. Many people think fewer accounts mean less risk. What actually happens is the opposite. Old accounts help build the length of your credit history. This is something lenders care about. Even if you no longer use those accounts, they still add positive weight to your score. Closing them can shorten your history and remove available credit, which might hurt your score.

Take a moment to check your older accounts for any fees or hidden charges. Leave them open to help your credit history if they are free to keep. You can use them for small purchases from time to time. Pay those off right away to keep the account active without adding debt. This helps maintain your credit history and available credit. These factors give your score steady support while you work on other improvements.

Moving Forward with Confidence

Bouncing back from a 525 credit score might feel like a huge task, but steady effort makes progress possible. Every wise choice you make builds a better financial future. You do not have to fix everything overnight. What matters is staying consistent and trusting the process. Credit recovery takes time, but each step brings you closer to your goals. Stay patient, keep learning, and move forward, knowing improvement is within reach.