Same-chain swaps should be straightforward since they occur within the same blockchain, avoiding complexities like bridging assets or navigating different consensus mechanisms. These swaps enable seamless trading of assets, reducing bottlenecks and enhancing the overall user experience.

Yet, traders often face significant challenges. Liquidity within a blockchain is frequently fragmented across multiple decentralized exchanges (DEXs) and protocols.

This fragmentation can result in insufficient liquidity for certain trades, leading to delays or higher slippage. Additionally, without proper aggregation, users may not secure the best possible prices, often losing money unnecessarily.

High transaction fees, especially on congested blockchains like Ethereum, remain a persistent issue. Moreover, navigating multiple DEXs to find the best rates and liquidity can be cumbersome, particularly for newcomers.

How Jumper Exchange Solves Same-Chain Inefficiencies

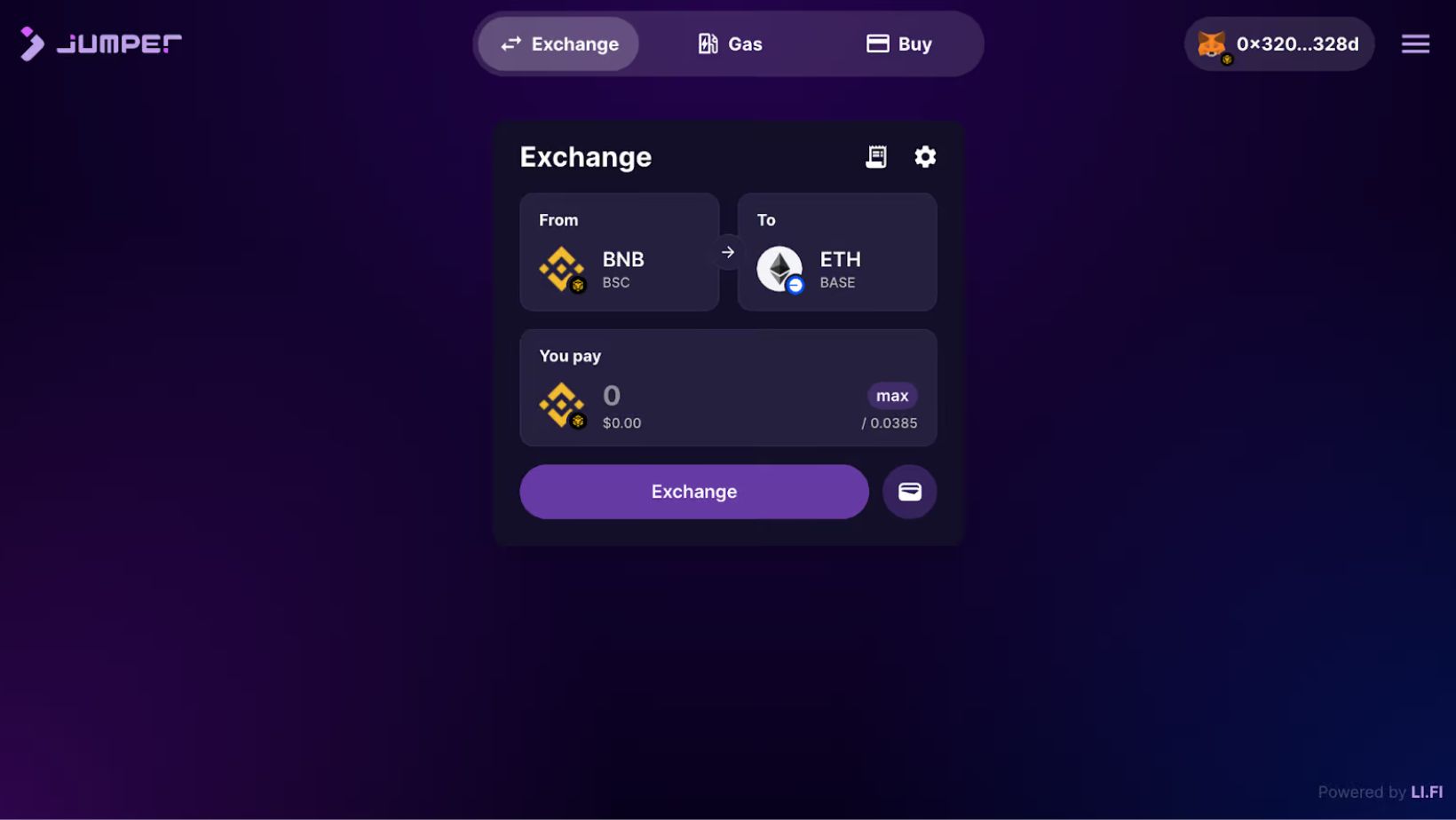

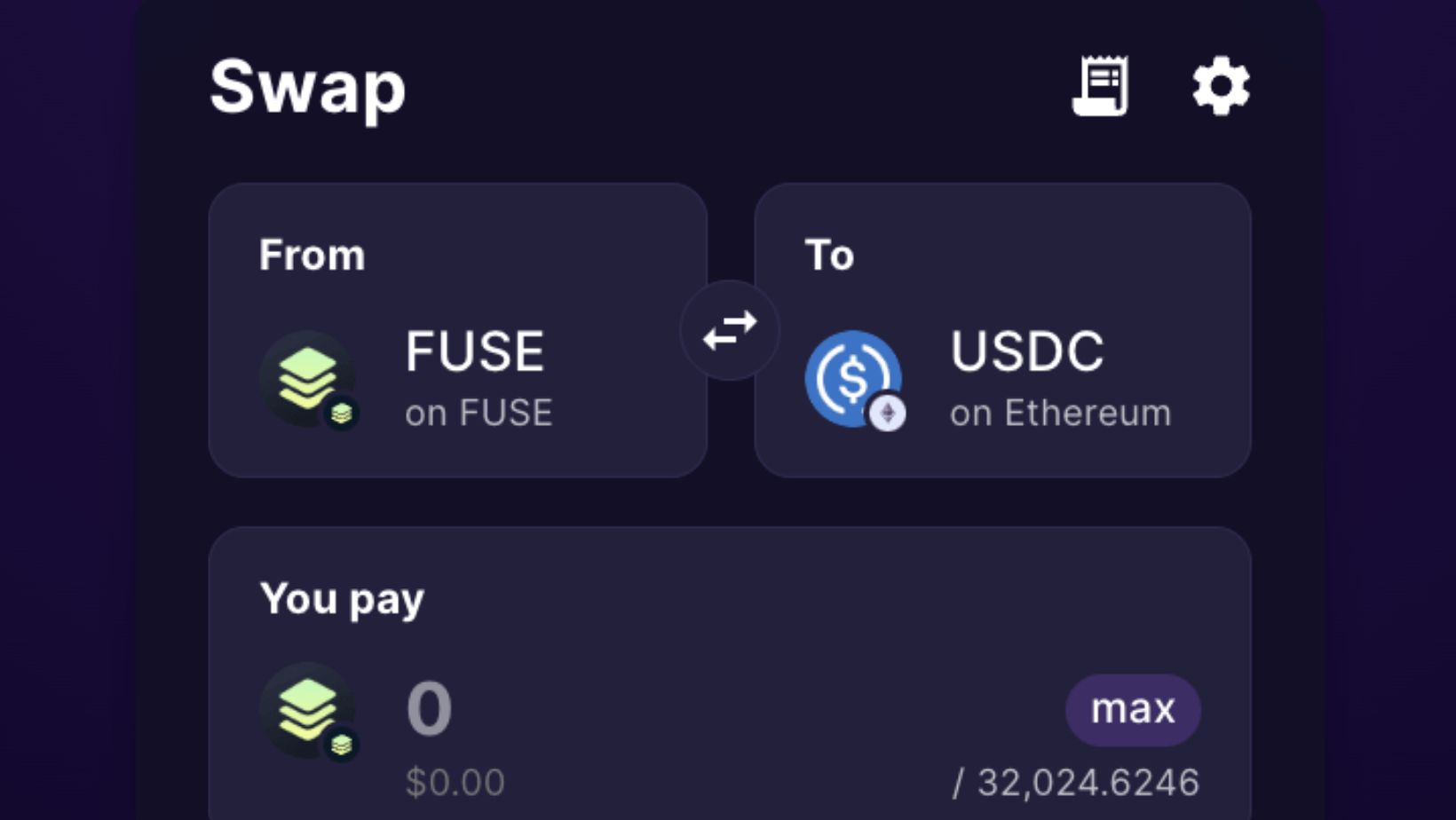

Jumper Exchange tackles these inefficiencies with a combination of innovative technology and a user-centric approach. One of its core features is liquidity aggregation, which pools resources from multiple sources within the same blockchain.

Instead of relying on a single DEX or liquidity pool, Jumper Exchange draws from various providers to ensure smooth trade execution. This approach not only guarantees sufficient liquidity but also minimizes slippage and ensures competitive pricing. For instance, when a user bridges from USDC on Base to SOL on Solana but the primary liquidity pool lacks reserves, Jumper Exchange seamlessly routes the trade through multiple pools to complete the transaction efficiently.

The platform also employs intelligent routing algorithms to determine the most efficient trade paths. Whether it involves splitting a transaction across several pools or identifying the DEX with the lowest fees, Jumper Exchange ensures optimal execution. This eliminates the need for users to manually compare rates across platforms, saving time and effort.

Optimizing Fees and User Experience

Fee optimization is another area where Jumper Exchange excels. By consolidating and streamlining transaction paths, the platform reduces fees associated with same-chain swaps.

This is particularly valuable on blockchains where network congestion often drives up costs. Additionally, Jumper Exchange provides a user-friendly interface that simplifies the trading process.

The Benefits of Jumper Exchange for Same-Chain Swaps

Jumper Exchange offers several benefits that make it stand out in the DeFi space. It minimizes costs by aggregating liquidity and optimizing trade routes, ensuring users achieve the best value for their trades.

The platform’s access to multiple liquidity sources and advanced routing algorithms guarantees fast and reliable trade execution, even during periods of high demand. By eliminating the need to manually search for the best rates or liquidity pools, Jumper

Exchange saves users time and reduces the complexity of managing trades. Moreover, its integration with trusted protocols and adherence to rigorous security standards ensures that user funds and transactions remain safe.

Unlocking Opportunities with Jumper Exchange

By optimizing same-chain swaps, Jumper Exchange enables users to trade assets within a blockchain without unnecessary hurdles. This simplification benefits casual traders, arbitrage enthusiasts, and investors managing diverse portfolios alike. With its combination of advanced technology and user-first design, Jumper Exchange maximizes efficiency and unlocks new opportunities for DeFi participants.